The President wants to bring in an extra $1.6 Trillion in taxes over the next 10 years. The Republicans who control the House of Representatives want to reduce the deficit by $2.2 Trillion over the same period to more than offset the $1.2 Trillion that continuing Bush Era tax cuts will ‘cost’ the government in revenue. The President insists that there will be no deal unless taxes go up on ‘rich’ people. He wants a ‘balanced’ approach to deficit reduction – some cuts in spending increases and more tax revenue. The Republicans don’t think that those who earn more should be treated differently than the ‘middle class.’ They don’t see what is essential about a ‘balanced’ approach.

It is a classic standoff. Of course, the President has the bully pulpit and the press on his side so he will win. The only problem is that we will all lose, no matter what the result. Why? We will lose because we have people deciding our fate who are serious about nothing except preserving their elected positions.

.

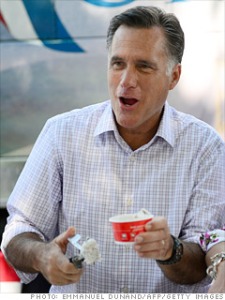

Liberal’s Free Ice Cream?

Or, Republican’s Free Ice Cream?

If the folks in Washington were serious about reducing our deficit, they would take action to do just that. They would stop spending more money than they are taking in each year. They, and I mean all of the politicians, red or blue, have no interest in cutting spending. They may want to cut the rate of spending increases but actually cut spending? No way. If politicians have nothing to give to their constituents, how will they get the votes to win reelection? They feel they must give everyone free ice cream to get their votes. And once they have given the ice cream once, we dumb voters expect it to continue or we will find a new politician who will give us what we want, more ice cream.

Do you think they are serious? If the goal is to reduce the National Debt, it will require that less is spent each year than is collected. Yet, both parties are putting forth ‘solutions’ that will only lower the amount by which we increase the deficit.

Let’s look at the Republicans first. They want to reduce spending by $2.2 Trillion over ten years by finding saving in various programs and be reducing entitlements. However, they agree that if the Bush-era tax cuts remain in effect, some $1.2 Trillion less revenue will be collected than if the reduced rates were allowed to expire. Assuming these possibly phantom savings occur and the guess of $1.2 Trillion is the amount of revenue lost, we will reduce (the increase in) our National Debt by $1.0 Trillion over ten years. Sounds nice if you don’t consider that we currently (and have done throughout Mr. Obama’s first term) spend $1.0 Trillion more EACH YEAR than we collect in revenues. So, by my reading, the Republican proposal will reduce the amount we add to our debt by $100 Billion each year. Seen from the other side of the coin, it will ‘only’ increase our deficit by about $900 Billion per year.

The Democrats’ proposal may be worse. It suggests that by only increasing taxes on the ‘rich’ we can bring in an additional $1.6 Trillion over the ten year period. They have talked about big savings when Obamacare takes effect, but, there is much debate about whether Obamacare will add costs or save. Assuming it is neutral, the Obama plan to cut deficits will be $60 Billion worse annually than the Republican plan.

Either way, Washington politicians want you to think they are taking care of you while letting someone else (usually “the rich”) pay off the huge debt the politicians have created. In fact, every proposal that I have heard, whether it be from the right or the left, will fail to lower the national debt and in doing so will cause inflation to increase. Eventually that creates an additional cost to every one of us. Think of it as the faceless tax on all of us.

When will we hear the first Washington politician propose a deficit reduction plan that: 1. will actually reduce the deficit; 2. will cause the entitled class (politicians, career bureaucrats, and their lobbies and contributors) to feel some of the pinch; and 3. will reduce the power of the federal government over the taxpaying public rather than increase it?

2 comments

Comments feed for this article

December 4, 2012 at 7:21 pm

The Mind of RD Revilo

Reblogged this on RD Revilo.

December 4, 2012 at 9:56 pm

Mark Torreano

When? When it snows on the Prez during his Kailua vacation.

Mark Mobile 808 343 4877